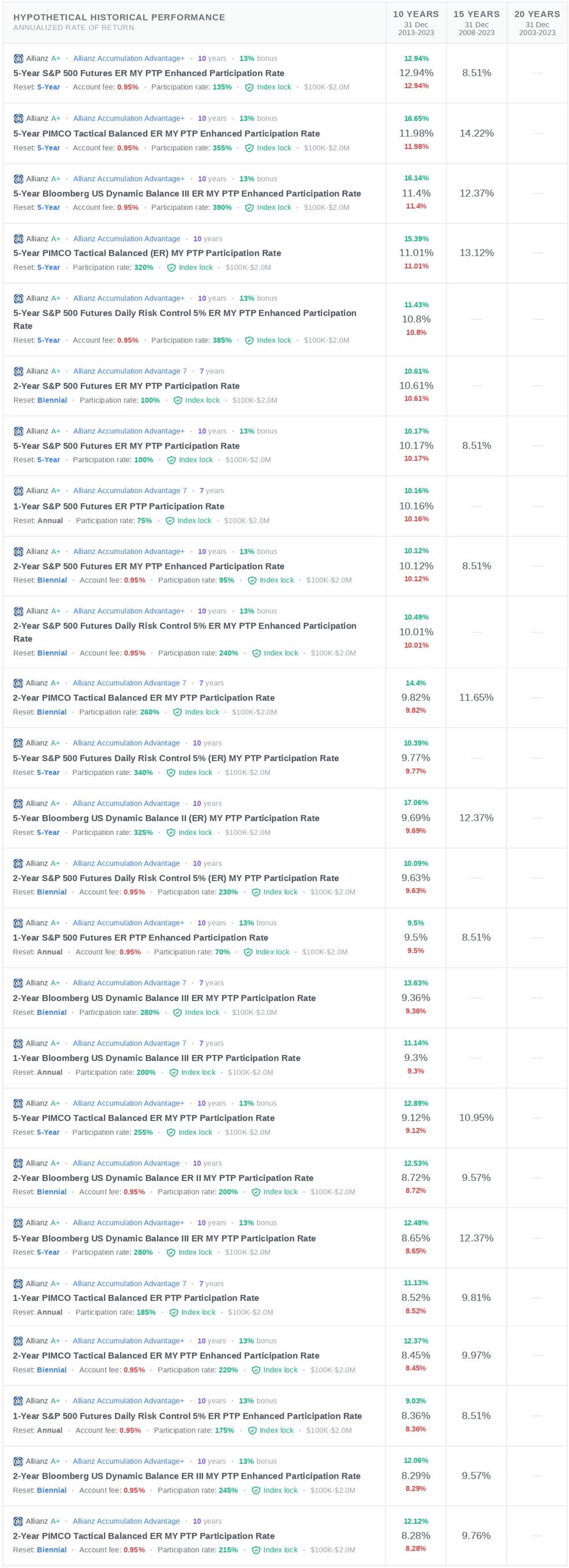

Allianz Accumulation Advantage Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

Allianz Life doesn’t charge any additional annual fees for their product.

Index Options

The Allianz Accumulation Advantage lets you pick from a variety of indexes to potentially earn interest based on their growth. These indexes include well-known options like:

-

S&P 500

-

BlackRock iBLD Claria ER Index

-

BlackRock iBLD Claria Index

-

Bloomberg US Dynamic Balance ER Index II

-

Bloomberg US Dynamic Balance Index II

-

PIMCO Tactical Balanced ER Index

-

PIMCO Tactical Balanced Index

Crediting Methods

Crediting methods are formulas that track index changes and translate them into potential interest earned by your annuity. They consider how the chosen index performs during a specific crediting period.

When it comes to Allianz Accumulation Advantage crediting methods, you have a few routes you can consider.

-

Annual point-to-point with a cap

-

Annual point-to-point with a participation rate

-

Monthly sum

-

MY (multi-year) point-to-point with a participation rate

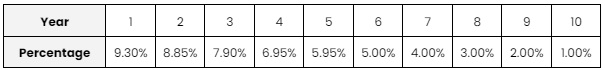

Annuity Surrender Charge Schedule

Similar to most annuities, the Allianz Accumulation Advantage applies surrender charges if you withdraw money before the annuity’s term ends. This penalty is a percentage of the withdrawal amount that gets smaller each year until it reaches zero when the contract is concluded.

Allianz Accumulation Advantage Key Features

Here’s an overview of Allianz Accumulation Advantage annuity’s key features, such as its market value adjustment (MVA) and Index Lock feature.

Market Value Adjustment (MVA)

-

A market value adjustment is an additional fee or credit tied to early withdrawals.

-

The MVA in the Allianz Accumulation Advantage annuity considers current interest rates (usually measured by corporate bond yields) and compares them to the rates when you initially invested.

-

Depending on the current interest rate environment, the MVA could either increase or decrease the value of your withdrawal.

Index Lock

-

During each crediting period, you can lock in an index value for a chosen allocation option (investment strategy). This locks in a potential interest rate based on that value.

-

With the annual method, interest is applied at the end of the year based on the locked value and participation rate.

-

Multi-year method gets interest credited sooner, based on the locked value for the year you activate it.

Allianz Accumulation Advantage Pros and Cons

-

No additional fees or charges

-

Seven different market indexes available with decent caps

-

Four different crediting methods available

-

Allianz Accumulation Advantage is RMD friendly

-

Excellent ratings from top rating companies

-

Flexible premiums and withdrawal amounts

-

Allianz Accumulation Advantage Index Lock Feature

-

Market value adjustments on withdrawals

-

10-year surrender period

-

Most of the indexes have significant volatility control, which limits the potential return of the index

-

$20,000 minimum premium

-

No free withdrawals in cases of terminal illness or nursing home care

Key Takeaways

In short, if you’re looking for a fixed indexed annuity that prioritizes accumulation, The Allianz Accumulation Advantage could be a strong fit for your savings goals.

This product offers decent growth but with the inclusion of principal protection (decent caps and participation rates).

This annuity focuses on straightforward growth without optional add-ons. This may or may not work as an incentive, depending on what type of product you’re interested in.

However, with a 10-year surrender period, it’s not a suitable investment for those who care about the short-term horizon.

Still, the Allianz Accumulation Advantage is a good product that may help you grow your retirement savings without bearing unnecessary risks.

Company information

Company Name

Allianz Life of North America

Website

Phone Number

800-950-1962

A.M. Best Rating

A+ (superior)

Moody’s Best Rating

Aa3 (fourth-highest)

S&P'S BEST RATING

AA (very strong)

About the Product

Product Name

Allianz Accumulation Advantage

Product Type

Fixed Indexed Annuity

Product Information

The Allianz Accumulation Advantage is a fixed-indexed annuity, combining indexed annuity growth potential with a guaranteed minimum interest rate. This translates to the potential for market-driven returns alongside a safety net of guaranteed income payments.

In simpler terms, fixed-indexed annuities offer a chance for your investment to grow based on market performance while still securing a guaranteed minimum income stream for your retirement. This combination makes them a compelling option for investors seeking both growth possibilities and a layer of security.

Account Types

Personal, Traditional IRA, Roth IRA, SEP-IRA, Simple-IRA, 403(b)

Not Available In

NY, PR, VI