American Pathway Fixed 5 Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

The American Pathway Fixed 5 annuity has no initial sales charge or annual fee, making it an attractive option for those looking to avoid upfront costs. However, there are withdrawal charges applicable to amounts exceeding the penalty-free withdrawal limit during the initial surrender period.

Index Options

The American Pathway Fixed 5 does not utilize index options since it is a traditional fixed annuity. Instead, it offers a fixed interest rate for a specified period.

Crediting Methods

The interest rate is fixed and guaranteed for a specific term. The rate can vary depending on the amount of premium deposited. Currently, the highest yield for a five-year term is around 5.05%.

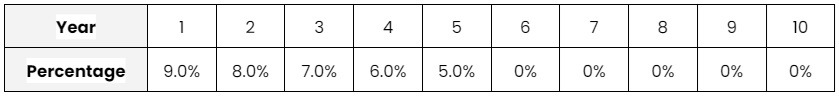

American Pathway Fixed 5 Annuity Surrender Charge Schedule

The surrender charge schedule typically spans five years, with the charge percentage decreasing each year. After the fifth year, withdrawals are free from these charges. Starting from the second contract year, up to 15% of the contract value can be withdrawn each year without incurring a penalty.

If you don't use the full 15% penalty-free withdrawal allowance in a given year, up to 5% of the unused portion can be carried over to the next year, potentially allowing up to 20% withdrawal without penalty. Withdrawals exceeding these limits may incur market value adjustments (MVA) if the interest rate environment changes, which can either increase or decrease the withdrawal amount based on current rates compared to the rates at the time of the contract's issuance.

This table shows the surrender charge penalties for early withdrawals from the American Pathway Fixed 5.

American Pathway Fixed 5 Key Features

American Pathway Fixed 5 has the following key features:

Guaranteed Interest Rates

The annuity offers fixed interest rates that are guaranteed for specific terms (one, three, five, or seven years). The current highest guaranteed annual yield for a five-year term is around 5.05% for premiums between $100,000 and $1,000,000.

Free Withdrawals

Starting from the second contract year, you can withdraw up to 15% of the contract value each year without incurring penalties. This allows for flexibility in accessing funds while avoiding withdrawal charges.

Market Value Adjustment (MVA)

This feature applies to withdrawals exceeding penalty-free amounts during the initial interest rate guarantee period. The adjustment can increase or decrease the withdrawal amount based on current interest rates compared to the rates at the time of contract issuance.

Optional Return-of-Premium Guarantee

This option allows you to cancel the annuity and receive the greater of your initial premium (minus any withdrawals), the contract value minus charges, or the minimum withdrawal value. Selecting this option may result in a slightly lower initial interest rate.

Penalty Waivers for Specific Conditions

The annuity offers waivers for withdrawal penalties in certain situations, such as terminal illness, extended care confinement, or inability to perform activities of daily living. These waivers provide added security and flexibility for accessing funds during critical times.

Pros and Cons

-

Guaranteed interest rates for up to 5 years

-

Tax-deferred growth

-

Flexible payout options

-

Principal protection

-

Penalty-free withdrawals up to 15% annually

-

Systematic withdrawal options

-

Potential surrender charges for early withdrawals

-

Market value adjustment (MVA) during the initial term

-

Withdrawal charges for amounts exceeding penalty-free limits

-

MVA can decrease withdrawal amount if interest rates rise

-

Withdrawal limitations during the first year

-

Lower interest rate with return-of-premium guarantee

Key Takeaways

The American Pathway Fixed 5 offers a reliable solution for those seeking stable and predictable growth in their retirement savings. With a guaranteed interest rate for a five-year term, tax-deferred growth, and flexible liquidity options, it caters to both growth and security needs.

Additionally, features like the minimum guaranteed surrender value and penalty waivers for specific conditions add a layer of protection and accessibility. This annuity is ideal for investors looking for a medium-term commitment with the assurance of principal protection and consistent returns, making it a valuable addition to a well-rounded retirement strategy.

Company information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P'S BEST RATING

A+ (middle of the investment grade)

About the Product

Product Name

American Pathway Fixed 5

Product Type

Multi-Year Guarantee Annuity (MYGA)

Product Information

The American Pathway Fixed 5 is a single premium, tax-deferred annuity with a guaranteed interest rate for up to 5 years. It provides principal protection and offers systematic withdrawal options. The annuity includes penalty-free withdrawal privileges of up to 15% annually after the first year. Market Value Adjustment (MVA) applies during the initial term. It also waives withdrawal penalties upon death, providing a death benefit to beneficiaries.

Account Types

Non-Qualified, 401(k), IRA, Spousal IRA, Pension, IRA Rollover, 401(a), IRA Transfer, TSA 403(b), SEP IRA, IRA-Roth, 1035 Exchange, TSP

Not Available In

Varies by state