American Pathway VisionMYG Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

The American Pathway VisionMYG Annuity has no initial sales charges or annual fees. However, if you withdraw more than the penalty-free amount before the end of the surrender charge period, you will incur a withdrawal charge and possibly a market value adjustment (MVA). The MVA can increase or decrease your withdrawal amount based on interest rate changes since the annuity was issued.

Index Options

This product is a fixed multi-year guarantee annuity and does not offer index options. It provides guaranteed interest rates for the selected term.

Crediting Methods

This annuity uses immediate crediting. This means interest crediting begins on the effective date of the contract, ensuring that your investment starts earning interest right away.

The interest rate is fixed and guaranteed for the duration of the chosen term (e.g., 4, 5, 6, 7, or 10 years). After the initial term, the interest rate is declared annually and will not fall below the minimum guaranteed rate specified in your contract.

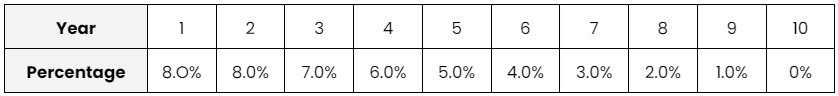

American Pathway VisionMYG Surrender Charge Schedule

The surrender charge schedule for the American Pathway VisionMYG varies based on the selected term of the annuity. If you withdraw more than the penalty-free amount before the end of the surrender charge period, you will incur these charges. Additionally, a market value adjustment (MVA) may apply, which can either increase or decrease the withdrawal amount depending on the current interest rate environment.

Here is a detailed example of the surrender charge schedule for a 10-year term:

American Pathway VisionMYG Annuity Key Features

American Pathway VisionMYG has the following key features:

Guaranteed Interest Rates

The annuity offers multi-year guarantee periods, allowing you to lock in interest rates for terms ranging from 4 to 10 years. This means you can benefit from predictable growth, with interest rates set for the chosen period. For instance, current rates include 5.3% for a 4-year term and 3.7% for a 10-year term. These rates provide a stable foundation for your investment, protecting it from market fluctuations.

Tax-Deferred Growth

This annuity allows for tax-deferred growth, meaning that you won't pay taxes on the interest earned until you make withdrawals. This can lead to more substantial growth over time, as the money that would have gone to taxes remains invested, earning additional interest.

Flexible Payout Options

You have several options for receiving your money from the American Pathway VisionMYG. You can choose to withdraw the entire amount as a lump sum at the end of the term or opt for periodic payments that can provide a steady income stream during retirement. This flexibility can help you tailor your withdrawals to your financial needs and goals.

Principal Protection

One of the most attractive features of the American Pathway VisionMYG is the protection of your principal. The amount you initially invest is safeguarded against market downturns, ensuring that you won’t lose your principal. This is particularly important for conservative investors looking to preserve their capital while earning a reasonable return.

Liquidity Options

The annuity includes provisions for liquidity, allowing you to make penalty-free withdrawals under certain conditions. After the first year, you can withdraw up to 15% of your contract value annually without incurring surrender charges. Additionally, there is a 30-day window at the end of the initial guarantee period, during which you can make full or partial withdrawals without any penalties.

Pros and Cons

-

Guaranteed interest rates for 4 to 10 years

-

Tax-deferred growth

-

Flexible payout options

-

Principal protection

-

Penalty-free withdrawals up to 15% annually

-

Interest begins crediting immediately

-

Potential surrender charges for early withdrawal

-

Limited to penalty-free withdrawal amounts annually

-

Market value adjustment (MVA) during the initial term

-

Withdrawal charges may apply after the penalty-free period

-

MVA can reduce withdrawal amount if interest rates rise

-

Withdrawal limitations during the first year

Key Takeaways

The American Pathway VisionMYG is a solid option for those seeking a fixed annuity with guaranteed interest rates for terms ranging from 4 to 10 years. It offers tax-deferred growth, principal protection, and flexible liquidity options, including penalty-free withdrawals under specific conditions.

This annuity provides a predictable and stable growth path for your investment, making it a suitable choice for conservative investors aiming to secure their retirement savings. With no initial sales charges or annual fees, VisionMYG ensures that more of your money works for you, helping you achieve your long-term financial goals with confidence.

Company information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P'S BEST RATING

A+ (middle of the investment grade)

About the Product

Product Name

American Pathway VisionMYG

Product Type

Multi-Year Guarantee Annuity (MYGA)

Product Information

The American Pathway VisionMYG is a single premium, tax-deferred annuity offering guaranteed interest rates for terms ranging from 4 to 10 years. It provides principal protection, tax-deferred growth, and multiple payout options, including penalty-free withdrawals of up to 15% annually after the first year. Market Value Adjustment (MVA) applies during the initial rate term, and systematic withdrawals are available. The annuity waives withdrawal penalties upon death, providing a death benefit to beneficiaries.

Account Types

Non-Qualified, 401(k), IRA, Spousal IRA, Pension, IRA Rollover, 401(a), IRA Transfer, TSA 403(b), SEP IRA, IRA-Roth, 1035 Exchange, TSP

Not Available In

Varies by state