American General Power Index 5 Plus of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

The Power Index 5 is a fixed index annuity with no annual fees.

Index Options

With Power Index 5, you can earn interest based on three different indices:

-

S&P 500 Index (US stocks)

-

NASDAQ-100 Index

-

Bloomberg US Dynamic Balance Index II

Crediting Methods

Your assets can grow based on the performance of the index interest account you select, calculated as follows:

-

Initially, interest is determined by the index's performance over a one-year period. This is measured as the percentage change of the index from one contract anniversary to the next.

-

Next, interest is modified by index rate caps, which can limit or reduce the amount of interest earned.

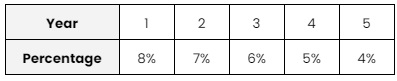

Annuity Surrender Charge Schedule

As for the annuity surrender charges, the Power Index 5 is no different than any other annuity product. If you decide to withdraw your money earlier than stated in the contract, you will be faced with a fee. This fee is a surrender charge that gradually lowers each year until it reaches 0%.

In the case of American General Power Index 5, the annuity term is 5 years, with the first year being the most costly to withdraw money.

American General Power Index 5 Plus Features

There are quite a few American General Power Index 5 Plus advantages, but the most important one is:

Minimum Accumulation Value (MAV)

- Ensures premium growth of at least 1%.

- Can be adjusted to prior withdrawals and applicable charges.

- Secures the higher value of your contract or MAV on the 5th contract anniversary and afterward.

Pros and Cons

-

RMD friendly

-

Guaranteed Growth rate of at least 1%

-

Short-term annuity

-

Up to 10% penalty-free withdrawals from the second year and ongoing

-

$25,000 minimum contribution

-

Available only in NY

-

No riders available

Key Takeaways

Power Index 5 is a fixed index annuity for a term of 5 years. Overall, it ensures a guaranteed growth of at least 1%. Moreover, as a tax-deferred investment, the tax is only applied when you start withdrawing your investment, meaning that given enough time, your assets will have the potential to accumulate enough for your comfortable retirement.

When investing in fixed index annuity, Power Index 5 will grow regardless of whether the index is performing positively or negatively. Hence, for some, this option may be a secure investment in the long run.

Company information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P'S BEST RATING

A+ (middle of the investment grade)

About the Product

Product Name

Power Index 5

Product Type

Fixed Indexed Annuity

Product Information

The Power Index 5 is a 5-year fixed index annuity product with guaranteed growth opportunity. By investing in a single tax-deferred premium, retirees can benefit from guaranteed income for life and protection from market downturns.

Account Types

Non-Qualified, IRA, IRA Rollover, IRA Transfer, SEP IRA, IRA-Roth, Stretch IRA, Inherited IRA, NQ Stretch, and TSP

Not Available In

New York