Power Select Plus with Lifetime Income Plus Multiplier Flex Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

Power Select Plus with Lifetime Income Plus Multiplier Flex is available for an additional cost of 1.0% of the Income Base. The Income Base is the amount on which lifetime withdrawals are based.

Matched or Doubled Interest

The Power Select Plus with Lifetime Income Plus Multiplier Flex annuity allows you to:

- Match your interest to earn income immediately (your annual income credits match the rate of interest earned in the annuity after activation)

- Double your interest to increase your earnings in the future (before activation)

- Add changes with the Flexibility rider, such as coverage, pre-activation withdrawals, and more.

Protection for Unexpected Life Situations

The Power Select Plus with Lifetime Income Plus Multiplier Flex annuity offers built-in protection for unexpected life situations. The annuity holder can benefit from free withdrawals under the following circumstances:

- Extended care – Available after receiving extended care for at least 90 consecutive days after the first year of the contract.

- Terminal illness - Available if the annuity holder is diagnosed with a terminal illness after the contract date.

- Nursing home - Available if the annuity holder requires a nursing home or assisted living facility in which case withdrawal charges may be weaved.

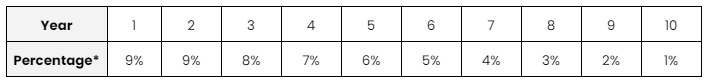

Power Select Plus - Lifetime Income Plus Multiplier Flex Surrender Charge Schedule

The Power Select Plus with Lifetime Income Plus Multiplier Flex includes surrender charges that are applied as a percentage of the account value. You can benefit from the 10% penalty-free withdrawals from the second year of the contract. However, a higher amount will incur the following charges:

*The interest rate may vary depending on the state.

Power Select Plus with Lifetime Income Plus Multiplier Flex Features

The Power Select Plus with Lifetime Income Plus Multiplier Flex annuity is an attractive product that comes with advantageous features and riders. Here are some of them:

Market Value Adjustment (MVA)

If interest rates at the time of withdrawal are higher than when the contract was issued, the MVA will reduce the withdrawal amount. Similarly, if interest rates are lower, the MVA will increase the withdrawal amount. Even if the MVA reduces the withdrawal, it will not fall below the minimum value specified in your contract or MVA endorsement.

The MVA does not apply to death benefits, permitted RMDs, 10% penalty-free withdrawals, or annuitization.

Annuitization

The Power Select Plus with Lifetime Income Plus Multiplier Flex offers lifetime income through annuitization at no additional cost or through a feature known as a Guaranteed Living Benefit (GLB) rider for an annual fee. After the third year of the contract, the policyholder can choose to annuitize the contract, meaning it will be converted into a series of payments. Withdrawal charges and MVA will not be applied.

In the case of annuitization, the GLWB will be canceled, along with the lifetime income withdrawals.

Power Select Plus - Lifetime Income Plus Multiplier Flex Pros and Cons

-

RMD-friendly

-

Crisis waivers available

-

Annuitization option available

-

Flexible withdrawals

-

Match and Multiplier features available

-

Guaranteed lifetime withdrawals of up to 7.35%

-

High minimum investment ($25,000)

-

10-year surrender charge

-

Possible market value adjustments on withdrawals

Company Information

Company Name

Corebridge Financial

Website

Phone Number

800-448- 2542

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (sixth-highest)

S&P’s Best Rating

A+ (middle of the investment grade)

About the Product

Product Name

Power Select Plus with Lifetime Income Plus Multiplier Flex

Product Type

Fixed Annuity

Product Information

Power Select Plus with Lifetime Income Plus Multiplier Flex is a fixed annuity offered by Corebridge Financial that is designed to provide a secure retirement income.

It offers features such as penalty-free annual withdrawals, built-in protection for unexpected life events, and a guaranteed lifetime income option.

With a 10-year term, you can benefit from rising income through annual credits and offer flexibility through annuitization without additional withdrawal charges or market value adjustments.

Account Types

Non-Qualified, 401k, IRA, IRA Rollover, IRA Transfer, TSA 403b, SEP IRA, KEOGH, IRA-Roth, 1035 Exchange, and TSP

Not Available In

n/a