Power 5 Protector Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

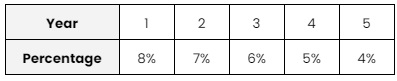

If you withdraw more than the penalty-free amount during the surrender period, the Power 5 Protector surrender schedule applies. The surrender charges start at 8% in the first year and gradually decrease to 4% in the fifth year. Additionally, a market value adjustment might be applied to early withdrawals.

Index Options

The annuity's interest is linked to your chosen indexes' Power 5 Protector performance. You may select a combination of the following indexes:

-

ML Strategic Balanced

-

MSCI EAFE

-

PIMCO Global Optima Index

-

Russell 2000

-

S&P 500

Power 5 Protector Annuity Surrender Schedule

The Power 5 Protector surrender schedule includes fees you would incur if you withdraw more than the penalty-free amount during the surrender period.

Contract Year Surrender Charge

Power 5 Protector Key Features

Here's an overview of the Power 5 Protector benefits, such as its market value adjustment (MVA) and penalty-free withdrawals.

Market Value Adjustment (MVA)

- MVA changes depending on the performance of the chosen index.

- MVA charges only apply to clients who want to withdraw funds early; these fees won't be charged if you own your contract to its maturity date.

Penalty-Free Withdrawals

- The penalty-free withdrawal amount provided after the initial contract year is up to 10% of the contract value and is noncumulative.

- State variations apply.

Death Benefit

- It waives withdrawal penalties upon death.

- The named beneficiary(ies) will receive a death benefit equal to the total accumulation value.

Pros and Cons

-

Safety and Security: This fixed-indexed annuity offers a unique blend of safety and security. Gains are linked to a positive change in a market index, allowing investors to receive some upside but none of the downside

-

Potential for Higher Returns: It offers higher returns than traditional fixed-income investments like bonds and bank CDs

-

Penalty-Free Withdrawals: After the first contract year, you can withdraw up to 10% of the previous contract anniversary contract value without incurring any company-imposed charges.

-

Surrender Charges: You will incur surrender charges if you withdraw more than the penalty-free amount during the surrender period. The surrender charges start at 8% in the first year and gradually decrease to 4% in the fifth year

-

Market Value Adjustment (MVA): A market value adjustment might be applied to early withdrawals, which could reduce the amount you receive

-

Limited Upside Potential: While the Power 5 Protector provides some of the upside of the linked index, the potential gains are limited by caps, spreads, or participation rates

Company information

Company Name

American General Life Insurance Company

Website

Phone Number

1-800-445-7862

A.M. Best Rating

A (excellent)

Moody’s Best Rating

A2 (Good)

S&P'S BEST RATING

A+ (Strong)

Product Information

Product Name

Power 5 Protector

Product Type

Fixed Indexed Annuity

Product Information

This annuity is a hybrid of indexed and fixed annuities, providing indexed annuity benefits at a fixed interest rate. This means it guarantees a set amount of income payments. Fixed-indexed annuities offer the potential for market-linked growth while providing a guaranteed retirement income stream, making them an excellent option for more conservative investors.

Account Types

Non-qualified, 401(k), Individual Retirement Account (IRA), IRA for Spouse, Transferred IRA, 403(b) Tax-Sheltered Annuity (TSA), Simplified Employee Pension (SEP) IRA, Roth IRA, 1035 Exchange, Extended IRA, IRA Inheritance, Non-Qualified Extended IRA, and Thrift Savings Plan (TSP)

Not Available In

NY