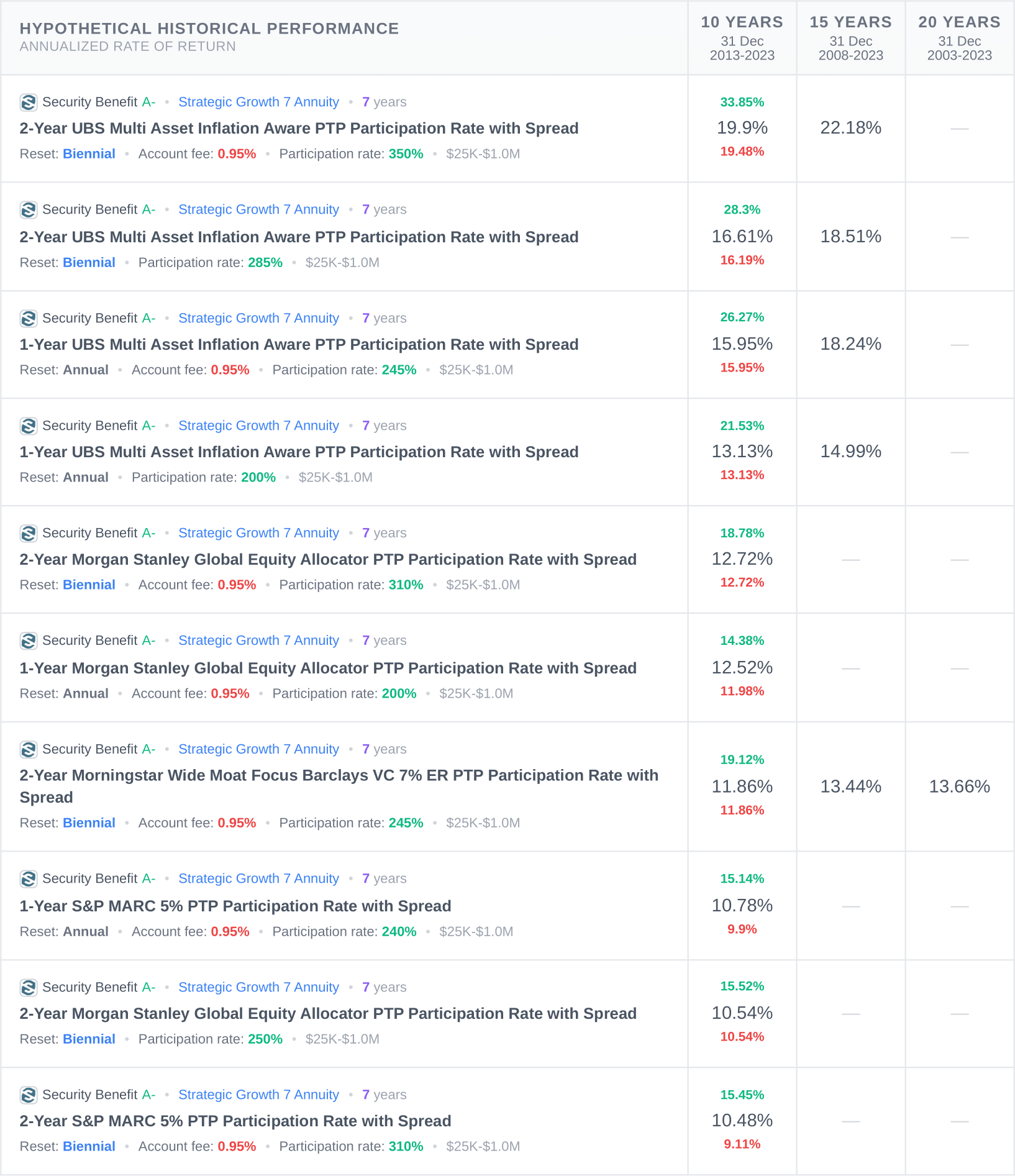

SBL Strategic Growth 7 Annuity Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions....

Fees and Charges

Security Benefit doesn’t charge any fees or expenses for this annuity unless you opt for an income rider.

Index Options

When choosing the SBL Strategic Growth 7 Annuity, you’ll be able to choose from multiple index crediting options, including:

-

1-Year Morningstar Wide Moat Focus Barclay's VC 7%

-

1-Year UBS Market Pioneers

-

2-Year Morningstar Wide Moat Focus Barclay's VC 7%

-

2-Year S&P 500 Low Volatility Daily Risk Control 5%

-

2-Year UBS Market Pioneers

-

S&P 500 Point-to-Point w with Cap

-

S&P 500 Point-to-Point with Participation

-

S&P 500 Point-to-Point with Participation and Spread

-

UBS Market Pioneers Index Account

-

UBS Multi Asset Inflation Aware Index Account

-

Morgan Stanley Global Equity Allocator Index Account

Crediting Methods

Crediting methods use mathematical formulas to determine the indexed interest an annuity earns based on index changes over the 'crediting period.' For the Security Benefit Strategic Growth 7 Annuity, the available crediting strategies are:

-

Annual with cap

-

Annual with a participation rate

-

Annual with a participation rate and spread

-

2-year with a participation rate and spread

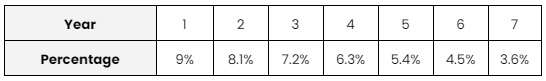

Annuity Surrender Charge Schedule

Like many annuity providers, SBL imposes penalties on early withdrawals from annuity contracts, known as annuity surrender charges. These charges are a percentage of the withdrawal amount and gradually decrease to zero over the contract term, which is also the case with the Strategic Growth 7 Annuity.

SBL Strategic Growth 7 Annuity Key Features

The Strategic Growth 7 Annuity from Security Benefit has several interesting features one should consider when choosing this investment. The three essential characteristics are:

Market-Value Adjustment (MVA)

- Market Value Adjustment (MVA) is charged on withdrawals that exceed the Free Withdrawal amount, on full surrenders, or on the death benefit issued when a Joint Owner who is not the spouse of the Annuitant dies.

- MVA fees are only incurred by annuity beneficiaries who opt for early withdrawal; no MVA fees are charged if you wait until the contract's maturity date.

- MVA fees aren’t charged in California.

Rate Buy-Up Feature

- The Rate Buy-Up feature can potentially increase the contract value allocated to each Index Account, which can lead to a higher interest credit rate through improved caps, participation rates, or reduced spreads.

- If, by the end of the surrender charge period, the total costs associated with this feature surpass the accumulated index interest credits (including those from non-buy-up options), the excess will be refunded to the contract’s Fixed Account.

- This refund does not apply if there is an excess withdrawal, which is defined as any withdrawal exceeding the annual free withdrawal limit.

Rate Lock

- SBL will secure the most favorable caps, spreads, and rates for the Interest Crediting options, selecting from those available either when the application is received or when the contract is issued.

- The rate lock is contingent upon the paperwork being complete and submitted within a 60-day window.

Pros and Cons

-

No extra charges

-

Over 33 index crediting options available

-

Stellar ratings from industry-leading companies

-

RMD-friendly

-

The Rate Lock and Rate Buy-Up features

-

A minimum subsequent premium of $1,000 is available before the first contract anniversary

-

High minimum investment ($25,000)

-

7-year surrender charge

-

Possible market value adjustments on withdrawals

Key Takeaways

Security Benefit Strategic Growth 7 Annuity is a great option for individuals who want to grow their retirement savings without exposing themselves to too much risk. The annuity offers multiple benefits and interesting features, including the Rate Buy-Up feature or Rate Lock, which can be particularly advantageous to the annuity beneficiaries.

Not sure if the Security Benefit Strategic Growth 7 is the right annuity for you? Take our Annuity Quiz or schedule a meeting with one of our professional advisors.

Company information

Company Name

Security Benefit Life Insurance

Website

Phone Number

800-888-2461

A.M. Best Rating

A- (excellent)

S&P'S BEST RATING

A- (strong)

About the Product

Product Name

Security Benefit Strategic Growth 7 Annuity

Product Type

Fixed Index Annuity

Launch Date

2023

Product Information

The SBL Strategic Growth 7 Annuity is a deferred fixed annuity that combines features of both indexed and fixed annuities. It provides the potential for returns similar to those of indexed annuities but at a fixed interest rate.

Fixed index annuities offer a guaranteed income, with growth potential tied to market performance. This makes them particularly attractive to conservative investors seeking stable returns and assured income during retirement.

Account Types

IRA, Non-qualified, Roth IRA, SEP IRA

Not Available In

N/A