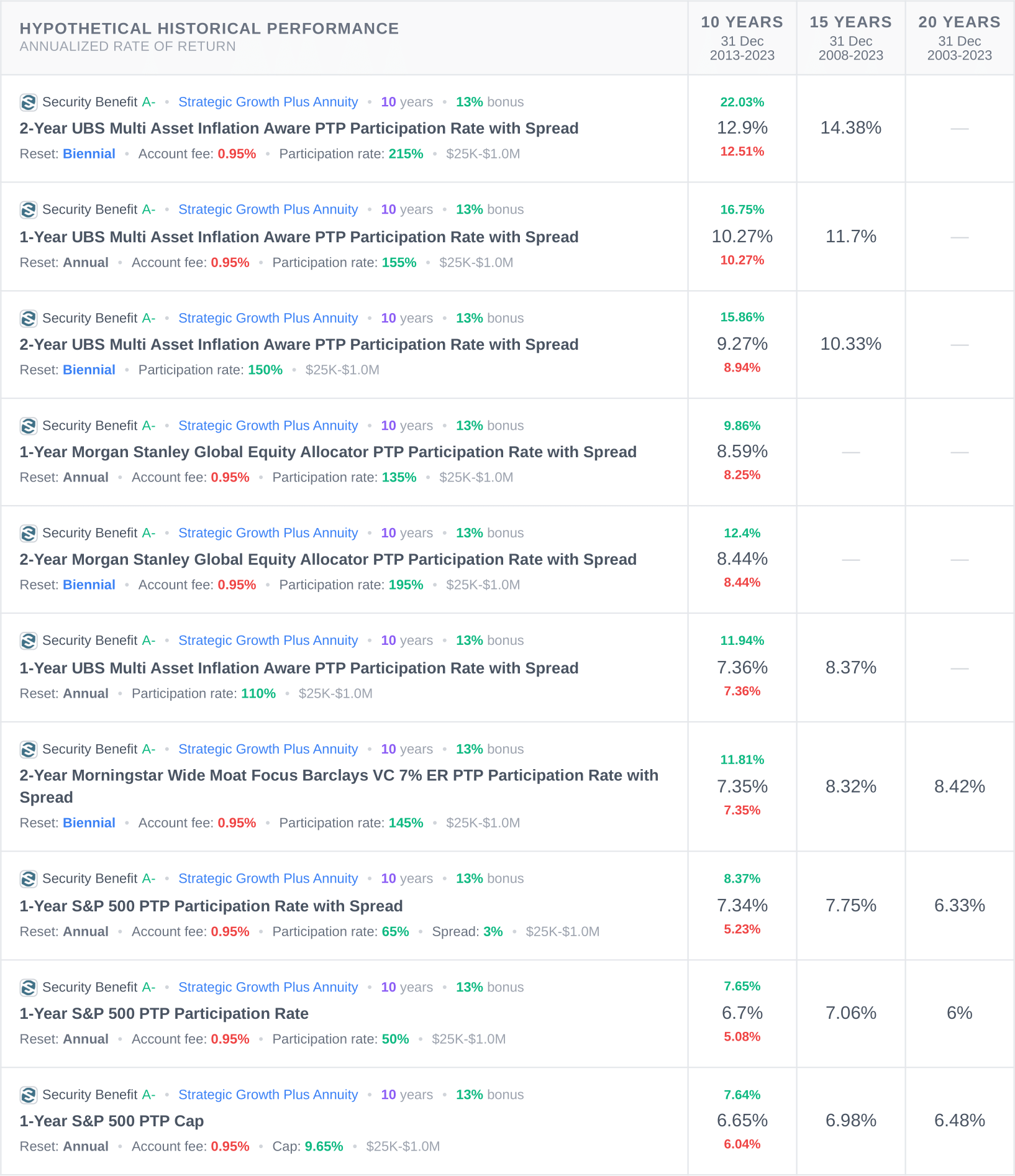

SBL Strategic Growth Plus Annuity Historical Rate of Return

The hypothetical historical performance provided herein showcases the annualized return of allocation strategies, representing the investment's annual growth rate considering compounding effects. Similar analyses can be found for each account in official fixed index annuity illustrations provided by insurance carriers.

What's not reflected:

The annualized return does not encompass rider charges, strategy fees, or applicable premium bonuses.

Notes on rates:

The information presented assumes the annuities' current caps, spreads, participation rates, and other related rates, without guarantee.

No guarantees:

These actual elements are subject to change over time, resulting in potentially higher or lower outcomes. Additionally, no single index consistently outperforms in every scenario. It is advisable to consult with a properly licensed and educated annuity professional before making any decisions.

Fees and Charges

Strategic Growth Plus annuity doesn’t have any charges or fees unless you decide to withdraw money early on, in which case there will be surrender charges.

Index Options

SBL Strategic Growth Plus annuity program offers multiple allocation accounts with attractive rates. To be precise, there are 32 index crediting options. Each of them is derived from 8 underlying indices and provides great opportunities to retirees.

-

1-Year Fixed Account

-

2-Year Morningstar Wide Moat Focus Barclays VC 7% ER PTP Participation Rate with Spread

-

1-Year S&P 500 Factor Rotator DRC2 7% ER PTP Participation Rate with Spread

-

2-Year S&P MARC 5% PTP Participation Rate with Spread

-

1-Year S&P MARC 5% PTP Participation Rate with Spread

-

2-Year Morgan Stanley Global Equity Allocator PTP Participation Rate with Spread

-

-

1-Year Morgan Stanley Global Equity Allocator PTP Participation Rate with Spread

-

-

2-Year S&P 500 LV DRC 5% TR PTP Participation Rate with Spread

-

1-Year Morningstar Wide Moat Focus Barclays VC 7% ER PTP Participation Rate with Spread

-

2-Year UBS Market Pioneers PTP Participation Rate with Spread

-

-

2-Year UBS Multi Asset Inflation Aware PTP Participation Rate with Spread

-

1-Year UBS Multi Asset Inflation Aware PTP Participation Rate with Spread

-

2-Year S&P 500 Factor Rotator DRC2 7% ER PTP Participation Rate with Spread

-

1-Year S&P 500 PTP Cap

-

1-Year S&P 500 PTP Participation Rate

-

-

-

2-Year UBS Market Pioneers PTP Participation Rate with Spread

-

-

1-Year S&P 500 PTP Participation Rate with Spread

-

2-Year Morningstar Wide Moat Focus Barclays VC 7% ER PTP Participation Rate with Spread

-

2-Year S&P 500 LV DRC 5% TR PTP Participation Rate with Spread

-

1-Year S&P 500 PTP Participation Rate

-

1-Year S&P 500 PTP Cap

Crediting Methods

Crediting methods use mathematical formulas to determine the indexed interest an annuity earns based on index changes over the 'crediting period.' For the Security Benefit Strategic Growth 7 Annuity, the available crediting strategies are:

-

Annual with cap

-

Annual point-to-point with cap

-

Annual with a participation rate

-

Annual point-to-point with a participation rate

-

Annual with a participation rate and spread

-

Annual point-to-point with a participation rate and spread

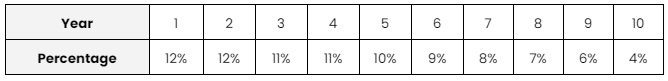

Annuity Surrender Charge Schedule

Similar to other annuities, the Security Benefit Strategic Growth Plus does have surrender charges for early withdrawals. The annuity product is planned for 10 years, meaning at the end of the term, you can access your funds fully without restrictions. Gradually, if you decide to withdraw from the program, the charge will be reduced every year until it reaches 0%.

SBL Strategic Growth Plus Annuity Key Features

The Strategic Growth Plus Annuity from Security Benefit offers features you may find promising in growing your retirement savings:

Market-Value Adjustment (MVA)

- Market Value Adjustment adjusts the annuity’s value based on the market. For example, if the rates fall, the value can rise. Commonly, the MVA is applied to withdrawals or surrenders made before the end of the contract’s term.

Rate Buy-Up Feature

- The Rate Buy-Up option has the potential to enhance the contract value allocated to each Index Account. As a result, this feature can potentially increase the interest credit rate by improving caps and participation rates or reducing spreads.

- If the total costs of this feature exceed the accumulated index interest credits by the end of the surrender charge period, the excess will be refunded to the contract’s Fixed Account.

Pros and Cons

-

No extra charges

-

32 index crediting options available

-

A bonus on all purchases

-

RMD-friendly

-

Rate Buy-Up feature available

-

Nursing and terminal illness waivers available

-

Guaranteed Minimum Interest Rate for the Fixed Account

-

High minimum investment ($25,000)

-

10-year surrender charge

-

Possible market value adjustments on withdrawals

Key Takeaways

The Security Benefit Strategic Growth Plus Annuity is a compelling option for those seeking to maximize their retirement savings with minimal risk. With its array of benefits and unique features, such as the Rate Buy-Up and numerous index crediting options, this annuity offers valuable growth opportunities.

If you aren’t sure whether this annuity is the right investment for you, take our Annuity Quiz, or feel free to consult with our expert advisors for personalized guidance.

Company information

Company Name

Security Benefit Life Insurance

Website

Phone Number

800-888-2461

A.M. Best Rating

A- (excellent)

S&P'S BEST RATING

A- (strong)

About the Product

Product Name

Security Benefit Strategic Growth 7 Annuity

Product Type

Fixed Index Annuity

Launch Date

2023

Product Information

The Strategic Growth Plus Annuity from Security Life Benefit Insurance Company offers a unique blend of guarantees, bonuses, and 32 index crediting options. The annuity product is designed for people who want to grow their retirement savings without too much risk.

Account Types

IRA, Non-qualified, Roth IRA, SEP IRA

Not Available In

N/A