Annuity Lesson #21

Annuities As New Asset Class In Retirement

Jeremiah Konger

CEO

"While stocks and bonds have been a traditional asset mix helping to manage risk, it’s worth considering whether a fixed index annuity could be another income-focused alternative to help balance risk.."

While stocks and bonds have been a traditional asset mix helping to manage risk, it’s worth considering whether a fixed index annuity could be another income-focused alternative to help balance risk.

ROOTS OF THE 60/40 SPLIT

Modern Portfolio Theory examines how investors can construct a portfolio using different asset classes to maximize returns for a given level of market risk.1 First introduced by economist Harry Markowitz in the 1950s, Modern Portfolio Theory remains a mainstay of the investing and finance world today.

Under Modern Portfolio Theory, the 60/40 allocation of 60% stocks (equities) and 40% bonds generally has represented a typical starting point for benchmarking risk tolerance.

As people age and get closer to retirement, this allocation often shifts, becoming more heavily weighted to bonds than stocks. Following Modern Portfolio Theory, it would not be uncommon for a person nearing retirement to have a portfolio where the weighting of stocks and bonds is reversed: 60% bonds and 40% stocks.

Why stocks and bonds? Risk and reward are generally positively correlated in investments. The higher the risk of loss, the greater the potential for reward. The lower the potential for loss, the lower the potential for rewards.

Stocks are both higher risk and higher reward. Bonds offer lower risk and lower reward. Additionally, bonds can provide a source of predictable income.

A NEW ASSET MIX?

Today, based on a variety of economic conditions, this mix of assets — stocks and bonds — is coming under increased scrutiny as an appropriate allocation for retirees.

First, bonds aren’t the only incomeproducing asset class that can be used to balance out the risks of stocks. Second, bonds are subject to certain economic factors, including inflation.

BOND BASICS

Bonds can help you add diversification and stability to your overall retirement strategy and are commonly considered less volatile than stocks. In fact, as interest rates have generally declined since the early 1980s, many bonds have provided solid long-term returns.

However, while bonds can be an attractive addition to an overall retirement income strategy, they are not without risk. In fact, if you’re counting on bonds to help you save for retirement or to generate retirement income, you could find that their value has decreased when it’s time for you to cash in or reinvest in another bond.

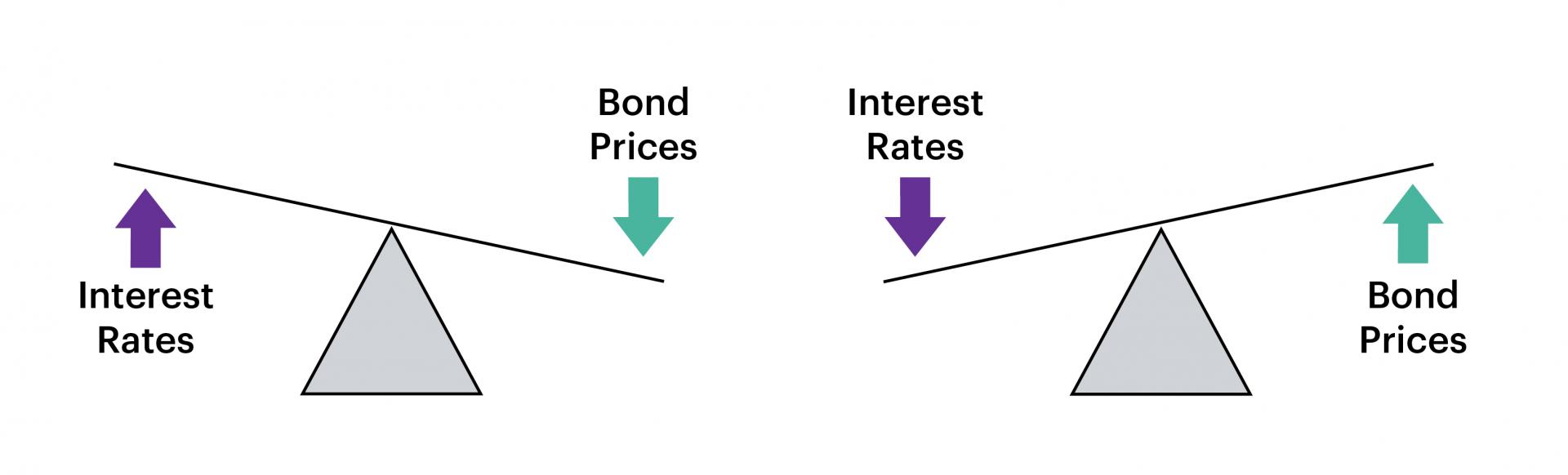

Bonds fluctuate in value in inverse correlation to changes in interest rates. When interest rates go up, a bond’s value goes down, and vice versa.

INFLATION’S IMPACTS

Current economic conditions — continued low interest rates3 and rising inflation4 — may prove particularly troublesome for bonds. While interest rates are low, bonds seem like a good choice; however, as interest rates start to rise, bond rates go down.

Meanwhile, inflation is responsible for pushing up the cost of the things we buy, and rising inflation lessens the purchasing power of one’s money, including any income derived from bonds.

For example, consider a basket of goods that cost $100 at a grocery store today. If the inflation rate is 3%, that means that same basket of goods will cost $103 at the store one year later. Someone holding a short-term bond with a yield of 1% would see the value of a $100 bond investment rise to $101 over the year. But if the cost of goods is now $103, that person just lost $2 in purchasing power.

Hypothetical purchasing power of $100 after one year At 3% inflation $100 groceries today = $103 groceries next year At 1% yield $100 invested in a bond = $101 value next year

While some inflation is a good thing that keeps the economy growing, the Federal Reserve tries to help achieve a balance so there’s neither too much nor too little, aiming for a steady 2% average inflation rate. One strategy the Federal Reserve uses to help control inflation is by influencing interest rates. When inflation is too high, the Federal Reserve typically raises interest rates. And as we’ve just discussed, those rising interest rates mean falling bond rates.

While the Fed has stated that its current plan is to leave rates alone for at least the next two years, rising consumer prices have some wondering if an inflationary surge is near and whether the Fed could change course.

Longtime investor Warren Buffett signaled his caution on bonds in February 2021, saying “bonds are not the place to be these days” in his annual letter to Berkshire Hathaway shareholders. He compared the 0.93% yield on a 10-year Treasury bond at the end of 2020 to the 15.8% yield available in September 1981, a drop of 94%.

ANOTHER INCOME OPTION

Bonds aren’t the only asset with less risk associated with market volatility and that can generate predictable income. Fixed index annuities are another option.

An annuity is a contract between you and an insurance company, where the purchaser pays a premium in exchange for a variety of guaranteed payout options for a set period of time or for the remainder of his or her life. The two phases of annuities are the accumulation phase, where the contract value accumulates interest earnings, and the distribution phase, where income is paid out from the annuity. They are the only financial product that can guarantee income as long as you live. The guarantees of an annuity are backed by the financial strength and claims-paying ability of the issuing insurance company.

Fixed index annuities offer not only principal protection but also the potential to earn interest on your principal, up to a certain amount, based on an external market index such as the S&P 500. When you buy an FIA, you don’t own any shares of stock or participate directly in the market. You own an annuity contract.

FIAs credit interest to your annuity based on a formula (determined by the insurance company and outlined in your contract) that decides how additional interest from the index is calculated and credited to your contract value. FIAs offer protection of principal from market losses along with the potential to provide higher interest than traditional fixed annuities.

There are several potential costs and limitations you should consider before purchasing an FIA.

• Your premium is not liquid, meaning you may not be able to withdraw it from the annuity without incurring surrender charges, which are penalties levied against withdrawals made before the surrender date stated in the annuity contract.

• You can purchase various optional riders with an annuity to offer additional benefits, such as enhancing your lifetime income in various ways, but those riders may come at additional cost.

• Caps establish how much of an index’s gains you participate in. For example, if an annuity has a cap of 3%, that is the maximum credited interest you can receive. If the index increases 10%, you would receive 3%.

However, negative returns in an index don’t negatively affect your annuity; if the index decreases 3%, you receive no credited interest.

BALANCING RISK

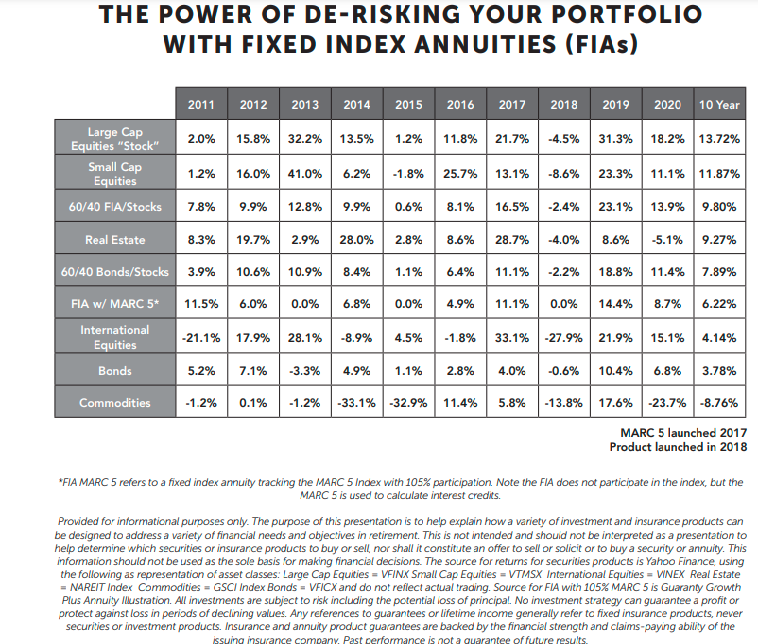

This chart illustrates the hypothetical potential of using fixed index annuities (FIAs) as the financial tool to balance out the risk of stocks in a portfolio. Shown are the annual and 10- year average returns for some of the most common asset classes and portfolio mixes.

As you can see, timing the market is nearly impossible given that returns vary widely each year, for almost all categories. This highlights the importance of having a diversified portfolio.

If we look at simple diversification, combining two asset classes in a 60/40 “less risk, less potential/more risk, more potential” example, which is common for many retirees, we see that a 60/40 bond/stocks mix showed an average return of 7.89%. A 60/40 allocation featuring an FIA with crediting interest based on 105% of the performance of the MARC 5 index (60%) and large cap stocks (40%) had an average return of 9.80%. This is just one example, using one type of annuity with a specific crediting strategy; it is provided not as a recommendation but as an illustration of the potential role an annuity can play in an overall retirement portfolio.

CONCLUSION

While stocks and bonds have been a traditional asset mix helping to manage risk, it’s worth considering whether a fixed index annuity could be another income-focused alternative to help balance risk.

As you consider the risk and reward in your personal portfolio, know that there is no onesize-fits-all answer. That’s why it’s important to consult with a qualified financial professional who can assess your timeline to retirement and your level of risk tolerance before recommending a potential asset mix to help take you to and through retirement.

Annuity Expert

Jeremiah Konger

PS - Here's 3 ways we can help you learn more about annuities.

1. Watch Videos on How to Identify The Highest Paying Protected Income & Growth Annuities.

2. Watch Videos That Reveal What to Look For When Buying A Protected Growth Annuity.

3. Click Here To Access Our Annuity Review Vault To Compare The Pro's and Con's of Dozens of Annuities.

Annuity Association is the leader in providing Independent Annuity recommendations for protected income, safe growth and other benefits in retirement.

-

Serving All 50 States

-

-

Annuity Association

759 SW Federal Hwy Ste 200H

Stuart, FL 34994

© Copyrights 2025 by Annuity Association. All Rights Reseved.