Nationwide Peak 10 Historical Rate of Return

Fees and Charges

Investing in the Nationwide Peak 10 annuity means you need to commit to a 10-year contract. There are no fees or charges unless you have to pay for an early withdrawal penalty.

Index Options

Nationwide Peak 10 offers five different indexes, so there are plenty of options to choose from to diversify your portfolio. Nationwide allows its annuity holders to choose either one of the indexes or a combination of a few.

The AB Growth and Value Balanced IndexSM seeks to provide steady returns by rotating between growth and value stocks, managing bond durations to adjust for interest rate changes, and using diversification and volatility control to stabilize outcomes.

The BNP Paribas Global H-Factor® Index aims to reduce human bias by removing stocks more likely to lose value, resulting in lower volatility and more consistent returns through data-driven decisions.

The J.P. Morgan Cycle IndexSM looks to outperform the market by adjusting equity styles in line with the business cycle and rebalancing bonds based on current market trends, with a focus on domestic "smart beta" asset allocation.

The S&P 500® Index is a popular measure of the American economy, tracking the performance of 500 large publicly traded U.S. companies.

The S&P 500® Daily Risk Control Index provides exposure to the S&P 500 while maintaining a 5% volatility limit by adjusting asset allocation between stocks and cash, depending on market conditions.

Crediting Methods

The Nationwide Peak 10 has two crediting options that include:

- 1-year term: 1-year term is available for fixed and index cap crediting options.

- 2-year term: 2-year terms are only available for index participation crediting options.

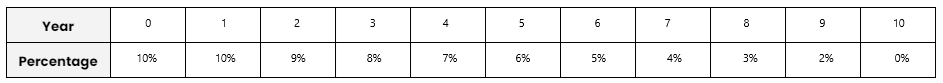

Nationwide Peak 10 Surrender Schedule

Nationwide has a 10-year surrender charge period for the Peak 10 annuity. Here is a table of charges that will be applied if you decide to withdraw money earlier than stated in the contract.

*The interest rate may vary depending on the state.

Nationwide Peak 10 Key Features

Nationwide Peak 10 advantages for future retirees include:

Market Value Adjustments (MVA)

- If you end your contract or take out more than your allowed 10% withdrawal in a year before the surrender charge period ends, a Market Value Adjustment (MVA) might apply.

- If MVA is applied, the adjustment can either increase or decrease the amount you get, depending on how interest rates have changed since you bought the annuity.

Tax-Deferred Growth

- Nationwide Peak 10 is a tax-deferred annuity, meaning you don’t pay taxes on the gain until you take a withdrawal.

Nationwide Peak 10 Pros and Cons

-

No extra charges

-

RMD-friendly

-

Death benefit and terminal illness waivers available

-

Spouse protection

-

Guaranteed Income Solution feature

-

High minimum investment ($25,000)

-

Long surrender charges

-

Possible market value adjustments on withdrawals

-

Single premium without the possibility to add more money later

Company Information

Company Name

Nationwide

Website

https://www.nationwide.com/

Phone Number

1-877-669-6877

A.M. Best Rating

A+ (Excellent)

S&P’s Best Rating

A+ (Strong)

About the Product

Product Name

Nationwide Peak 5

Product Type

Fixed Index Annuity

Product Information

The Nationwide Peak 10 is a 10-year fixed-indexed annuity offering five index options for potential growth. It provides a blend of security and flexibility with features like a guaranteed fixed account and protection from market downturns. Designed for long-term savings, it also includes limited free withdrawals and surrender charge periods.

Account Types

Nonqualified, traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, charitable remainder trust and 401(a)

Not Available In

N/A