Nationwide Peak 5 Historical Rate of Return

Fees and Charges

If you invest in Nationwide Peak 5, you will be pleasantly surprised that there are no annual or administration fees. The only time you might need to pay is for a penalty in the case of early withdrawal.

Index Options

Nationwide Peak 5 offers four different indexes, and you can diversify your investing portfolio with the S&P 500®, MSCI EAFE Index, Morgan Stanley 3D Index, J.P. Morgan Mozaic IISM Index, or a combination of both. Here are a few details about each of them:

The S&P 500® index is a well-known measure of the American economy's health. It tracks the performance of 500 publicly traded U.S. companies.

The J.P. Morgan Mozaic IISM index focuses on investing assets that have been doing well recently, assuming they will continue to perform well. Every month, it looks at 15 types of global investments and picks the top 9 that show the best returns over the past 6 months.

The Morgan Stanley 3D index blends different types of assets with market trends to find growth opportunities while trying to keep a balanced performance.

The MSCI EAFE index is another option offered by Nationwide. It invests in a range of international stocks from developed countries outside North America, such as Europe, Australia, and Asia.

Crediting Methods

The Nationwide Peak 5 has a number of crediting methods, which will mainly depend on your chosen index option and other factors included in your contract.

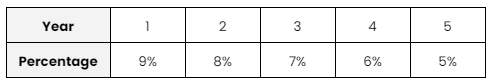

Nationwide Peak 5 Surrender Schedule

Nationwide imposes a 5-year surrender charge period for the Peak 5 annuity. This means that each year, the penalty percentage will decrease until it reaches 0%, at which point you can withdraw your savings.

*The interest rate may vary depending on the state.

Nationwide Peak 5 Key Features

Nationwide Peak 5 advantages go beyond waivers and protection from market risk. Here are the key features:

Market Value Adjustments (MVA)

- Market Value Adjustments may apply if you need to withdraw money from your contract during the surrender period, which is 5 years for Nationwide Peak 5.

- The way MVA works often depends on the interest rate. If the interest rate decreases, MVA will increase the amount of money you can get from your withdrawals. The opposite happens if the interest rate increases.

Tax-Deferred Growth

- With Nationwide Peak 5, your annuity may grow tax-deferred. It means that your contract value earns interest, your interest earns interest, or you earn interest on the money you would’ve paid in taxes.

- With this feature, you can accumulate more assets and let your money grow in the annuity.

Nationwide Peak 5 Pros and Cons

-

No extra charges

-

RMD-friendly

-

Death benefit and terminal illness waivers available

-

Spouse protection

-

Short surrender period

-

High minimum investment ($25,000)

-

Possible market value adjustments on withdrawals

-

Single premium without the possibility to add more money later

Company Information

Company Name

Nationwide

Website

https://www.nationwide.com/

Phone Number

1-877-669-6877

A.M. Best Rating

A+ (Excellent)

S&P’s Best Rating

A+ (Strong)

About the Product

Product Name

Nationwide Peak 5

Product Type

Fixed Index Annuity

Product Information

Nationwide Peak 5 is a 5-year annuity that you can purchase with a single payment of a minimum of $25,000. It offers interest rates that are linked to the performance of the indexes you choose and comes with a death benefit and spouse protection.

This is a tax-deferred annuity, meaning you can earn more money in the long run and not lose interest to taxes.

Account Types

Nonqualified, IRA, Roth IRA, SEP IRA, SIMPLE IRA, charitable remainder trust, and 401(a)

Not Available In

N/A