Nationwide Summit Historical Rate of Return

Fees and Charges

The Nationwide Summit annuity has no fees or charges unless you decide to withdraw your savings early on.

Index Options

Nationwide Summit comes with two available annuities: the S&P 500® Index and the J.P. Morgan Mozaic II℠ Index.

The S&P 500® Index is one of the most commonly followed equity indexes and the indicator of the American economy's performance. The index also consists of 500 large-cap, publicly traded companies.

The J.P. Morgan Mozaic II℠ Index is another index you can choose to diversify your portfolio. It reviews 15 global asset classes and selects the top 9 that offer the best returns over the last six months. The index later spreads investments across them to reduce volatility and aim for more stable returns.

Crediting Methods

The Nationwide Summit annuity is rather limited in its crediting methods and only offers fixed-indexed annuities from the S&P 500® Index and the J.P. Morgan Mozaic II℠ Index.

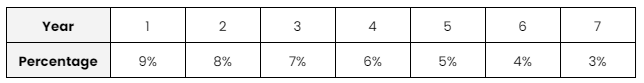

Nationwide Summit Surrender Schedule

Nationwide imposes a 7-year surrender charge period for the Summit annuity. This means that each year, the penalty percentage will decrease until it reaches 0%, at which point you can withdraw your savings.

*The interest rate may vary depending on the state.

Nationwide Summit Key Features

Nationwide Summit advantages go beyond waivers and protection from market risk. Here are the key features:

Market Value Adjustments (MVA)

If you take money out of your annuity before the CDSC (Contingent Deferred Sales Charge) period ends, a Market Value Adjustment (MVA) might apply. Here’s what that means:

- If interest rates have increased, the MVA will reduce the amount of money you get from your withdrawal.

- If interest rates have decreased, the MVA will increase the amount of money you get from your withdrawal.

Tax-Deferred Growth

- As a tax-deferred fixed annuity, Nationwide Summit enables faster growth of your savings, as you earn interest not only on your initial investment but also on the interest and the amount typically lost to taxes.

Nationwide Summit Pros and Cons

-

No extra charges

-

RMD-friendly

-

Death benefit and terminal illness waivers available

-

10% penalty-free withdrawals

-

Spouse protection

-

High minimum investment ($25,000)

-

7-year surrender charge

-

Possible market value adjustments on withdrawals

-

Single premium without the possibility to add more money later

Company Information

Company Name

Nationwide

Website

https://www.nationwide.com/

Phone Number

1-877-669-6877

A.M. Best Rating

A+ (Excellent)

S&P’s Best Rating

A+ (Strong)

About the Product

Product Name

Nationwide Summit

Product Type

Fixed Index Annuity

Product Information

Nationwide Summit is a single-payment deferred fixed indexed annuity for a term of 7 years. There is a minimum initial purchase in the amount of $25,000 without the possibility to add money later on.

There are no extra or hidden fees, except for a penalty in case you decide to withdraw your money early on.

Account Types

Nonqualified, IRA, Roth IRA, SEP IRA, SIMPLE IRA, charitable remainder trust, and 401(a)

Not Available In

N/A